Although we all need Life Insurance, it’s not accessible or affordable for all. Life insurance is a way to replace loss income if a person you depend on dies. In essence, it provides financial protection. However, some may not be insurable due to poor health or low income The best way to determine the amount and type of insurance needed starts with a financial plan. Therefore, when people ask what is the best insurance type or amount needed, the best answer is “it depends”. In addition, Life Insurance is also used for some non traditional uses such as, Business Succession planning and key person insurance, charity, Estate planning (funds to cover estate taxes and debt),and Retirement income. Also featured below is Equity Index Universal Life (EIUL). It’s permanent life insurance with a cash account the rises when he market does, but when the market goes negative, it stays fixed.

How much

However, when trying to determine the life insurance needs of a household, one approach would be to take the annual income of the insured and multiply it by 30. That would cover 30 years of income before retirement. Or, use a factor of 10 if you are 10 years from retirement. In both of these cases, a simple Term Life Insurance with a face value or 10 to 30 times the insured’s income is all that’s required. If your children plan to attend college, that would be a separate college investment account. Yet another for your retirement plan, and another plan for disability insurance, or living benefits.

If the insurance is for a business, more information may be needed to determine level of insurance required – Income Statement, Balance sheet, and Cash Flow Statement may be necessary.

Also, financial plans change over time. Thus, life insurance needs also change. Periodic review of your insurance needs are necessary. And, what if the family planning leads to a desire to check out some of the newer policies that offer death coverage forever, living benefits, and a cash account with anytime access. Plus, there’s more.

What is Life Insurance

Life insurance is income protection. At least that’s what conventional thinkers believe. We know from the examples above that life insurance has evolved, and thus, the uses of life insurance has changed, hopely for the better. Some of the permanent policies compete with market investments like mutual funds, stocks and bonds, all with far less risk. Indeed, smart financial planners take a more holistic approach. In a holistic approach, all of the investment plans work in concert to achieve the best overall performance.

The beneficiaries of the insurance policy will receive a cash payout. which can be used to cover funeral expenses, outstanding debt, replacement of lost income, the funding of education, living expenses, and even support for an inheritance. However, how the funds are spent will be the individual decision of the beneficiaries. The end result may or may not be consistent with the strategy of the financial plan.

The Basics

Life insurance premiums are paid annually, quarterly, or monthly. When paid, a percent of the premiums are subtracted to cover the operations of the business, and the Cost of Insurance. The remainder goes into a cash account. Only permanent life insurance policies have cash accounts, term policies don’t have a cash account. I’ll discuss more about cash accounts and permanent policy below. The cash account grows tax deferred at a specified rate to cover future premiums, withdrawals, loans, etc.. Permanent and Term are different policy types with different objectives, cost structure and payout plans.

Just the Facts

The primary class of policies are the following:

- Term Life Insurance: The base level term life insurance policy is quite simple. It pays out to the beneficiaries the face amount upon the insured’s death. The period of coverage is typically 10, 20 or 30 years of coverage. Once the time expires or the client stops paying premiums, the policy terminates. As mentioned above, term policies do not have cash accounts.

- Whole Life Insurance: This policy is designed to last for the the life of the insured provided the premiums are paid. As with all permanent policies, it has a cash account. The primary function of the cash is to generate sufficient growth to cover future premiums, and funds to guarantee a death benefit.

- Universal Life Insurance: This policy type is the most flexible of all permanent life insurance policies. It allows the insured to adjust the death benefit, premiums, and cash value amount.

- Variable Life Insurance: Variable policies permits the insured to invest the cash account into various investment options, such as stocks, bonds and mutual funds. The cash account is open to market loss with the potential for higher rates of return then the other permanent life insurance policies.

- Indexed Universal Life Insurance: Like other permanent life policies, it has a cash account. However, the cash value is linked to a market index, such as the S&P 500. And, unlike the Variable Life, which is subject to market lost, the Indexed Universal is a fixed product. And thus, never loses money. Also, it works well as a retirement investment since the cash can be sourced tax free.

Why so many types of Life Insurance – I’m confused

The various life Insurance products have exploded over time, especially with the introduction of Equity Indexed products. It’s similar to Variable Life, without the potential for market lost, which is why it’s labeled a fixed product. If you are looking for something simple with coverage for a specified time period, Term Life is a likely choice. However, many see the necessity of Term Life but want something that last longer, and can be terminated or surrendered whenever you wish.

What are Living Benefits

Living benefits are a way to accelerate some of the death benefit before you die. Conditions that trigger these benefits are Terminal Illness, Critical Illness and Chronic Illness. There are a number of other benefits available depending on the type of policy. They are called living benefits, because you don’t have to die to use them.

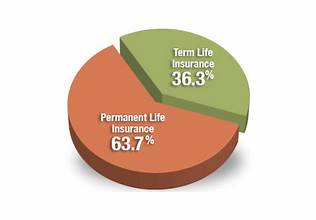

Term vs Permanent Life Insurance

AL Williams coined the phrase “Buy Term and invest the Difference”. He was the founder of Primerica, a brokerage firm noted for the application this investment strategy. Any deviation from this approach is highly criticized as an inferior financial plan. They argue that permanent life policies are expensive term policies and the cash account does not perform well. On the surface it’s a silly argument. The is room for many different options to construct a solid financial plan, that includes all of these items plus some.

However, the argument is not Term vs Permanent, but more appropriately, Mutual Funds vs Equity Index Universal Life (EIUL). EIUL is the new player. It is attractive as an investment choice because it does not lose money. And your cash is accessible tax free. When the index it’s linked to goes negative the value of the EIUL is zero. In other words, you gain when the index is positive and it’s zero when the index is negative, Because of this, it is considered a fixed product. However, you can see why this type of investment excites many investors. You get the upside growth of the market with no down side lost. And, with respect to insurance, an EIUL insurance is more like an Investment with permanent life insurance.

Evaluate

As you can see, the line between life insurance and investment policy have gotten blurred. And in this article, I only touched the surface. Stay tuned for other articles exploring this topic.

For more information see this site.

Thanks,

George